14 May 2025

China's Solid-State Battery Revolution: Decoding the Technical Routes, Key Players, Patents, and the Accelerated Path to Commercialization

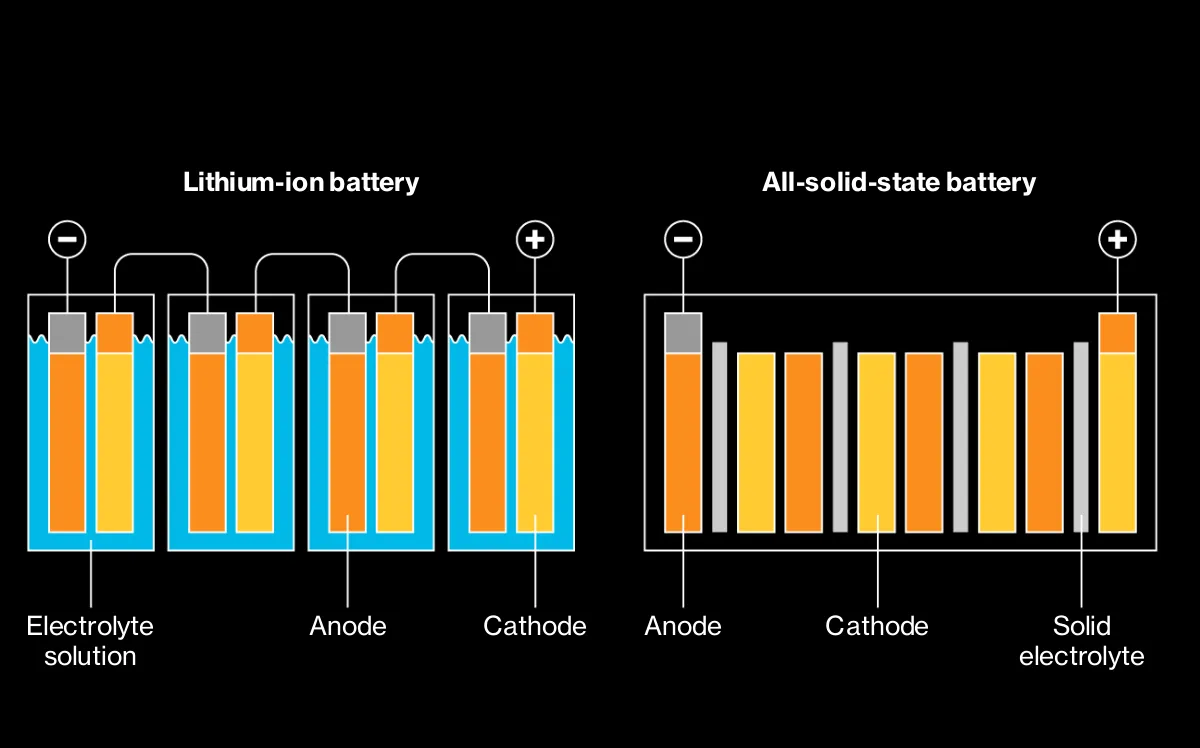

The global race for the next generation of battery technology is accelerating, and at its forefront stands China, charting a complex yet determined course towards solid-state batteries (SSBs). Replacing volatile liquid electrolytes with solid counterparts, SSBs promise a paradigm shift – higher energy density for extended range, enhanced safety mitigating thermal runaway risks, faster charging capabilities, and improved cycle life. These advancements are not merely theoretical; they are poised to redefine electric vehicles (EVs), grid-scale energy storage, and emerging sectors like low-altitude mobility.

This analysis delves deep into the intricate landscape of China's SSB development, drawing exclusively from recent insights and verified industry data. We dissect the diverse technical pathways pursued by leading manufacturers, examine their latest R&D breakthroughs and extensive patent portfolios, predict future trends, and map out the projected commercialization timelines. For procurement specialists, technical professionals, and strategic planners navigating the future energy terrain, understanding this multifaceted approach is paramount.

China's strategy is not monolithic. It reflects a dynamic ecosystem where established giants, innovative startups, and ambitious automakers are simultaneously exploring different routes, each with its own set of opportunities and formidable technical hurdles. Based on industry dynamics and patent intelligence, China's primary SSB technical routes can be broadly categorized:

The Sulfide Route: Targeting maximum energy density. Sulfide electrolytes boast the highest ionic conductivity, holding immense potential for energy densities exceeding 500 Wh/kg. However, they are chemically sensitive (reacting with air/moisture), require complex, inert-atmosphere manufacturing, and are currently high-cost. Key players include CATL, BYD, Gotion High-Tech, and SVOLT (under Great Wall). This route appeals to players aiming for the premium, high-performance market segment.

The Oxide Route: Prioritizing stability and compatibility. Oxide electrolytes offer excellent chemical stability and compatibility with existing liquid-lithium battery production lines, easing the transition to scale. Their main challenge lies in lower ionic conductivity, particularly at lower temperatures, requiring innovative solutions to boost performance. Representatives include WeLion New Energy, QingTao Energy, and Ganfeng Lithium. This path is often favored for its lower-cost transitional potential and adaptability.

The Composite Route: Seeking synergistic advantages. This involves combining the strengths of different electrolyte types (e.g., sulfide with halide, or oxides/polymers) through material composites or novel structural designs (like multi-layer electrolytes). The goal is to balance performance metrics – energy density, safety, stability, and conductivity – by leveraging the best features of each component. Farasis Energy and ProLogium (though the transcript focuses more heavily on domestic Chinese players, ProLogium is mentioned as a comparative example in the route

description context) are noted in this category.

The Progressive/Semi-Solid Route: A pragmatic transition. This pathway involves a staged reduction of liquid electrolyte content, starting with semi-solid batteries (SSBs containing a small percentage of liquid) as a transitional product, eventually moving towards fully solid systems. Its main advantage is high compatibility with existing production lines, lowering the immediate investment and mass production risk. This is notably pursued by OEM-affiliated entities or those with strong OEM partnerships, including GAC Group, SAIC Group, Changan Automobile, and Sunwoda,

as highlighted in the provided context focusing on OEM-related strategies.

This diversified approach indicates a calculated effort across the industry. Head companies are often dual-tracking or focusing on sulfide for peak performance, startups like WeLion and QingTao lean into oxide for faster market entry, and car manufacturers tend towards progressive routes leveraging existing capabilities. Let's examine the key players and their detailed strategies within these categories.

(1)Navigating the Sulfide Frontier: Ambition Meets Technical Complexity

The sulfide electrolyte route is the Everest of SSB development, promising the highest potential energy density but presenting the steepest climb in terms of technical difficulty and cost. Several Chinese powerhouses are committing significant resources to this path.

CATL: As a global battery leader, CATL adopts a dual strategy, pursuing both sulfide and condensed polymer routes in parallel. Their sulfide effort targets the theoretical 500 Wh/kg energy density made possible by the material's inherently high ionic conductivity (10−3 S/cm). The hurdles are significant: poor chemical stability requiring inert handling and complex manufacturing processes that drive up costs.

The condensed polymer route, while offering lower ionic conductivity, provides superior processability and compatibility with existing liquid battery lines, making mass production potentially more cost-effective. Its limitations include the need for composite materials to enhance conductivity and insufficient stability at high temperatures.

CATL's progress is tangible. In 2024, they successfully trial-produced a 20 Ah sulfide all-solid battery sample, placing their R&D at stage 4 out of their internal 9-stage rating system – a phase focused on key technology validation and sample development. With a dedicated SSB R&D team exceeding 1000 specialists, CATL aims to reach stages 7-8 (small-batch production) by 2027, targeting a leap from lab to pilot production. Their ambition extends to achieving scale production by 2030, driving costs down to 1.2 to 1.5 times that of liquid batteries and pushing energy density past 500 Wh/kg, though this hinges on deep collaboration with equipment suppliers (like Lead Intelligent) and material providers (like Tianli Technology) to build the requisite industrial ecosystem. Their initial market focus for SSB is high-end EVs, exemplified by anticipated collaborations with partners like BMW. The ongoing China All-Solid-State Battery Collaborative Innovation Platform is expected to accelerate standardization, potentially easing market entry.

CATL's patent activity underscores their rapid technical iteration, with a 71.94% growth in patent grants over the past two years, according to a report by Changjiang Securities. Their portfolio is strategically focused: over 40% in sulfide electrolyte synthesis and material modification (e.g., doping techniques to enhance conductivity and stability), interface optimization (like 'sandwich' structures to improve solid-solid contact and ion transport), and process technologies (like dry electrode and stacking standardization). For condensed polymers, patents focus on polymer/inorganic composites (enhancing mechanical strength and conductivity, preventing short circuits) and dry electrode processes (improving efficiency, reducing energy/environmental impact). A notable 2024 patent for a SSB testing device highlights their capability to precisely evaluate both sulfide and polymer batteries, validating their dual-route strategy. Their future technical direction includes developing sulfide/halide composite electrolytes to improve stability and conductivity simultaneously, particularly for low-temperature performance, alongside advancing dry electrode and stacking processes for mass production standardization.

BYD: BYD anchors its SSB strategy on sulfide electrolytes while pragmatically exploring oxide composite approaches to address the high cost of sulfide materials. By combining sulfide with lower-cost oxide electrolytes, they aim for a balance between high performance and mass production viability.

BYD has achieved a significant milestone with the trial production of a 60 Ah all-solid battery sample, marking a transition from lab research to engineering validation. This medium-scale cell boasts an energy density of 350 Wh/kg and a cycle life exceeding 2000 cycles, demonstrating competitive performance potential.

Their patent portfolio reflects this focus. Key patents include those on anode materials (optimizing silicon-based anodes to mitigate expansion, extending cycle life), conductive agents (innovative processes reducing interface resistance by 30%), and electrode slurry mixing (ensuring uniform coating for consistent performance and high yield). Over 50% of their SSB patents are concentrated on sulfide electrolytes (synthesis, structure, process), forming a core technical barrier. Composite route patents focus on crucial components like conductive agents and binders – notably, a composite binder patent enhances electrode structural stability and compatibility with high-nickel ternary cathodes, leveraging the latter's high energy density. This demonstrates a versatile and innovative approach to overcoming single-material limitations.

BYD's supply chain strategy is crucial. They collaborate with Nandu Power on oxide electrolyte development, integrating upstream resources. Furthermore, they leverage their extensive experience and mature supply chain from LFP battery production to accelerate SSB industrialization. Looking ahead, BYD plans to develop sulfide/halide composite electrolytes to enhance low-temperature performance, a known challenge for SSBs. They are also pushing for dry electrode technology standardization to improve compatibility with existing liquid battery lines.

Commercialization is planned in phases. BYD intends to launch small-batch trial installations in high-end models, such as the Denza brand, starting in 2027, targeting 1,000 to 20,000 units initially. Mass production is slated for 2030, aiming for cost parity with liquid batteries and broader adoption in mainstream models. A significant hurdle, acknowledged by BYD's Chief Scientist Lian Yubo, is the cost reduction required for sulfide electrolytes, needing to fall drastically from approximately 6,000 CNY/kg in 2025 to 500 CNY/kg by 2030. Lian also notes that SSB will require over five years for maturity and will initially target the premium market, with LFP continuing to dominate mid-to-low segments until potentially 2040, indicating a clear strategic segmentation.

Gotion High-Tech: Gotion positions sulfide all-solid batteries as their core direction while actively exploring halide routes and composite electrolyte innovations. Their 'Crystal Stone Battery' is a notable achievement on the sulfide path, showcasing impressive performance metrics: 350 Wh/kg gravimetric, 800 Wh/L volumetric energy density, 3000 cycles life, and successfully passing a 200°C thermal box test. This demonstrates high levels of energy storage, efficiency, and safety.

The halide route serves as a promising supplement, particularly for its potential in achieving high energy density, and is a focus of Gotion's R&D. Their composite innovation includes a perovskite composite solid-state electrolyte (PEO base + nano-TiO2 + perovskite quantum dots), which combines the flexibility of polymers, the mechanical strength of TiO2, and the electrical properties of perovskites. Notably, they incorporate biodegradable components, enhancing environmental sustainability – a unique blend of performance and ecological consideration.

Gotion's progress is validated by the development of a vehicle-grade 30 Ah Crystal Stone cell that passed rigorous thermal testing, confirming its safety and readiness for engineering validation towards automotive application. Their patent applications support this multi-route strategy. A patent for solid-state electrolyte materials and preparation combines biodegradable materials with polyethylene glycol (PEG), enhancing ionic conductivity and mechanical strength. Another patent improves electrode conductivity, reducing interface resistance by 30%. Their Electrochemical Impedance Spectroscopy (EIS) data processing patent enables automated analysis, accelerating R&D iteration. Collaboration with Eve Energy on continuous electrolyte membrane production processes further boosts industrialization prospects.

Gotion's comprehensive patent layout covers sulfide materials (synthesis, structure, electrodes), halide materials (synthesis, performance, compatibility – securing future potential), and unique composites like the perovskite-based electrolyte. Patents on battery testing and data processing reinforce their quality control and R&D efficiency. Their future technical plan includes developing sulfide/halide composites to improve low-temperature performance, aligning with a broader industry trend to tackle this challenge.

Commercialization follows a clear timeline: 2027 for trial installation in high-end EVs and testing, and 2030 for mass production, targeting a cost of 1.2 to 1.5 times liquid batteries and energy density over 400 Wh/kg. Key challenges for Gotion lie in scaling up sulfide electrolyte production and securing strong OEM partnerships to validate commercial feasibility.

Great Wall (SVOLT): Great Wall, primarily through its battery subsidiary SVOLT, focuses its SSB efforts on the sulfide route. They have achieved 400 Wh/kg in lab samples and target a significant leap to 600 Wh/kg by 2027, potentially offering exceptionally long range.

SVOLT's patents support critical areas of SSB development. A key patent for solid-state battery modules, packs, and energy storage systems incorporates elastic connectors and a removable design. This addresses the challenge of battery expansion during cycling, maintaining interface contact and enhancing safety, while the removable design facilitates maintenance. Another patent focuses on solid-state electrolyte coating preparation, using a composite base layer to balance conductivity and cost, crucial for sulfide electrolyte mass production. SVOLT's extensive experience with LFP battery manufacturing, particularly their 'Short Blade' cells and 'Flying Saucer Process' system, provides invaluable know-how for scaling up complex battery production processes, transferable to SSB.

Recent progress includes the successful development of small-capacity sulfide all-solid soft pack cells entering the engineering validation phase. SVOLT holds authorized patents in module design, including a "fortress structure" design for enhanced safety in challenging off-road applications, crucial for Great Wall's Tank brand, which is a potential target market for SSB.

Great Wall's commercialization plan is aggressive: trial installation in high-end EV models begins in 2026, with mass production of sulfide all-solid batteries (targeting 600 Wh/kg and cost <1.5x liquid) by 2027. Their market strategy targets high-end segments like the Tank brand, focusing on range and safety. SVOLT's existing overseas presence, such as their Thailand joint venture, offers a potential channel for global SSB deployment, leveraging their 26.77% overseas shipment ratio to navigate trade barriers.

Geely: Geely takes an OEM-led approach to sulfide all-solid batteries, employing a multi-technology synergy strategy. Their self-developed sulfide SSB lab samples have reached 400 Wh/kg, notably higher than current mainstream semi-solid batteries (~360 Wh/kg). They are also developing high-power fast-charging technology (3C for hybrid, 4C for EV), aiming for 10-minute charging for hundreds of kilometers of range upon mass production in 2025.

Beyond sulfide, Geely strategically diversifies by investing in WeLion New Energy, gaining exposure to oxide technology as an auxiliary route. Their subsidiary, Yao Ning New Energy, specifically the Naxun Solid-State Research Institute, conducts R&D on both sulfide and oxide routes and is capable of small-scale solid-state cell trials. Yao Ning's experience with their 'S+' technology for LFP batteries, known for safety performance, provides valuable process optimization insights applicable to all-solid technology. Geely also has a mass-produced semi-solid transition product, the 'Shenggdun Short Blade' battery, used in models like the Galaxy E5, which offers 192 Wh/kg energy density, 4C fast charge, and passes nail penetration tests, providing practical engineering validation experience. They are also leveraging AI collaboration (e.g., with Jieyue Xincheng) for vehicle-battery integration.

Geely's patent portfolio focuses on high-energy density materials, interface stability, production process compatibility, and safety. Their target is 2025 for mass production and vehicle installation. A key patent involves optimizing electrode and cell structure with variable thickness (thicker edges, thinner center) to improve lithium ion insertion uniformity, reduce dendrite risk, extend cycle life, and better accommodate high-energy density anodes like silicon-carbon. This directly addresses the challenging solid-solid interface issue. Their electrolyte patents cover both sulfide and oxide sintering, in-situ gel, and coating processes, with Yao Ning achieving impressive ionic conductivities (sulfide >7 mS/cm, oxide >0.8 mS/cm). Multi-layer stacking is used to improve electrolyte membrane uniformity. In terms of module design, a patent for battery swap stations features modular storage units highly compatible with SSB requirements, improving efficiency and lowering maintenance in swap scenarios.

If Geely achieves its stated goal of SSB installation by 2025, it would be a groundbreaking achievement for a domestic OEM, potentially challenging the timelines of major players like CATL and Toyota. Their full-chain approach, integrating battery tech with vehicle intelligence, aims to create a complete ecosystem, positioning them strongly for the future mobility market.

(2)Exploring the Oxide Path: Stability and Compatibility Lead the Way

The oxide electrolyte route offers a more stable and manufacturing-friendly alternative compared to sulfides, leveraging compatibility with existing liquid battery infrastructure. While ionic conductivity can be a challenge, innovators are finding ways to enhance performance.

WeLion New Energy: WeLion champions the oxide electrolyte route, specializing in composite solid-state electrolyte technology. Their core advantage lies in compatibility with existing liquid battery production lines, significantly reducing the cost and risk of transitioning to large-scale SSB manufacturing.

A unique 'pre-injection and solidification' process, likened to "boiling an egg," is central to their approach. Liquid electrolyte is first injected to fill gaps between electrodes and solid electrolytes, then solidified, dramatically improving solid-solid interface contact and ion transport. This process has enabled their semi-solid battery to reach 360 Wh/kg energy density, pass nail penetration tests safely, and achieve over 1100 cycles.

WeLion is rapidly industrializing, with four major bases planned (Beijing Fangshan, Jiangsu Liyang, etc.) totaling over 100 GWh in design capacity. Their 2024 capacity utilization reached 7 GWh, with plans to expand to 16 GWh in 2025. Their semi-solid batteries are already being mass-supplied to NIO for future vehicles and deployed in storage applications (e.g., 1,000 communication base stations in Dongguan by September 2025), demonstrating market traction in both EV and storage sectors.

Their extensive patent portfolio, exceeding 590 applications by June 2024, covers critical areas: interface optimization (addressing poor contact and high resistance), thermal management (innovative heat exchange and dissipation designs), and composite electrolyte synthesis. These patents form a robust technical system, bolstering product performance and market competitiveness. Strategic investors like Xiaomi, Geely, and Huawei provide valuable resources for market expansion and ecosystem integration.

WeLion plans to validate their second-generation semi-solid batteries in vehicles and accelerate storage deployment beyond base stations to industrial and commercial sectors. All-solid batteries are expected to enter small-batch mass production initially for high-end EVs and low-altitude aircraft – segments demanding high energy density and safety. By 2030, WeLion targets mass production of all-solid batteries with cost parity to liquid batteries, expanding penetration into mainstream EVs and storage systems.

QingTao Energy: QingTao adopts a clear, phased technical path: semi-solid, moving to quasi-solid, and finally all-solid, progressively reducing liquid content. Their first-generation semi-solid battery (5-15% liquid) is already in mass production and integrated into vehicles like the IM L6, achieving over 1000 km range. This success is built on innovative design: nano-scale solid electrolyte coating on ultra-high nickel cathodes for enhanced stability and ion transport, and a composite silicon-carbon anode with dry solid electrolyte layer integration for low internal resistance and fast charging.

The quasi-solid stage (<5% liquid) entered pilot scale in 2024, targeting 2025 mass production with a 20% cost reduction compared to liquid batteries. This phase requires approximately 60% production line equipment updates, indicating a moderate transition cost. The ultimate goal is all-solid mass production by 2027, targeting 500 Wh/kg energy density and a significant 40% cost reduction relative to current liquid batteries. Achieving this relies on composite electrolytes (oxide + halide) and interface optimization to improve mechanical performance and conductivity while simplifying the process for scalability.

QingTao's industrialization is evident with Gen 1 semi-solid batteries in the IM L6 and storage projects like 1,000 communication base stations by 2025. They operate four production bases (Beijing, Jiangsu, etc.), with 7 GWh capacity utilization in 2024. Their comprehensive patent layout covers materials (composite electrolyte combining halide/oxide advantages for safety/conductivity/cost), structure ("Roll Heart" patent with elastic layers preventing short circuits during winding, improving cycle life; Li enrichment electrode film optimizing interface contact), and process (dry electrode compatible with over 90% of liquid lines, reducing equipment conversion costs). Their patents create a robust technical barrier across the value chain.

QingTao's future strategy involves Gen 3 all-solid mass production by 2027, focusing on solid-solid interface optimization, low-temperature performance improvement, and anode-free battery R&D. They are rapidly expanding capacity, aiming for 100 GWh by 2025, covering materials to recycling. Deep collaborations with OEMs, including a 1 billion CNY joint venture with SAIC and strategic partnerships with BAIC and GAC, accelerate passenger vehicle application. Vertical integration from resources (like Wuhai Xingyi material base) to equipment and renewables projects (storage, wind/solar pairing) optimizes cost and compatibility, demonstrating a holistic ecosystem approach. QingTao aims for a leading position in all-solid commercialization by 2027.

Ganfeng Lithium: Ganfeng Lithium, primarily known for its lithium resource dominance, has made significant strides in SSB commercialization, successfully entering semi-solid mass production. As early as January 2022, their ternary solid-liquid hybrid batteries (oxide route) were deployed in Dongfeng E70 EVs for demonstration, accumulating over 500,000 km – validating real-world reliability. In 2023, the Chongqing Ganfeng 2 GWh battery park began construction, aiming to be China's largest SSB base.

Ganfeng's product roadmap is clear: Gen 1 and 2 use the oxide solid-liquid hybrid approach, leveraging compatibility and stability. Gen 3 transitions to sulfide all-solid for higher energy density and improved low-temperature performance. Their Jiangxi Xinyu base has 0.2 GWh semi-solid capacity, soon to be significantly boosted by the Chongqing project. OEM partnerships with Seres and Dongfeng are crucial; the launch of the Seres S5 with a Ganfeng battery marks a key entry into the passenger vehicle market, enhancing SSB visibility for consumers.

With over 280 patents by 2024 covering oxide and sulfide materials, structure, and processes, Ganfeng has built a solid IP foundation. A unique R&D focus is integrating Deep Learning and AI into battery design to optimize parameters and accelerate iteration. This approach helped them target 400 Wh/kg for Gen 2 solid-liquid batteries while improving safety.

Ganfeng's lithium resource advantage and full vertical integration (mine to recycling) provide significant leverage in raw material supply and cost control – a critical factor for SSB viability. For the challenging sulfide all-solid technology, they plan material modification (enhancing stability) and process innovation (low-temperature techniques) to enable mass production. Their Gen 3 all-solid targets an ambitious >500 Wh/kg. Mass commercialization of semi-solid batteries is expected this year, primarily targeting high-end EVs and storage. All-solid commercialization is projected around 2030, initially for the high-end market.

(3)Blending Advantages: The Composite Pathway

The composite route acknowledges that a single electrolyte material might not offer the optimal balance across all performance metrics, seeking synergy by combining different materials.

Farasis Energy: Farasis Energy follows a multi-pronged strategy: parallel development of oxide and sulfide routes, a progressive transition from semi-solid to all-solid, and coverage of various electrolyte systems (gel, titanium oxide, polymer, sulfide).

They have established a strong foothold in semi-solid batteries. Their first generation (2022 mass production in Dongfeng Voyah) achieved 280 Wh/kg and is used in high-end cars, heavy trucks, and low-altitude vehicles. Gen 2 boasts improved performance: 400 Wh/kg, 3C fast charging, and over 4000 cycles, with pilot mass production expected in 2025. Gen 3 maintains 400 Wh/kg but focuses on high-conductivity electrolytes and anode expansion inhibition, currently undergoing vehicle-grade certification.

On the all-solid front, their sulfide route is in industrialization development, achieving over 400 Wh/kg and successfully addressing thermal runaway risks. Large-scale validation is planned for 2025. Their oxide-polymer composite system, combined with lithium metal anodes and high-nickel cathodes, reaches an impressive 500 Wh/kg at low pressure. This system is targeted for small-batch installation in high-end applications like heavy trucks by 2027.

Farasis's industrialization foundation is bolstered by their SP (Super Power) technology, enabling direct cell-to-chassis integration for soft pack/stacking cells, significantly boosting mass production feasibility. Crucially, their existing production lines are readily upgradeable for SSB production, reducing transition costs and accelerating deployment.

Their robust patent portfolio covers their diverse technical approaches. In semi-solid, patents focus on gel solidification and coating optimization. For sulfide all-solid, the emphasis is on industrialization processes. For the oxide-polymer system, patents target achieving high energy density. Core technical patents include the use of lithium metal anodes and high-nickel cathodes for maximum energy density (e.g., the 500 Wh/kg target), stacking processes and soft pack encapsulation to address solid electrolyte's mechanical fragility and prevent cracking, and thermal management/safety features like self-shutdown functions to prevent thermal runaway. This comprehensive IP strategy protects their innovations across materials, structure, and safety.

Commercialization timelines are clearly segmented: Gen 1 semi-solid mass produced in 2022, Gen 2 pilot mass production in 2025, Gen 3 nearing vehicle certification. All-solid sulfide is under real-world testing, and the oxide-polymer composite system targets pilot installation in 2027. Farasis's progressive, multi-electrolyte approach, backed by strong industrialization tech, positions them as a key player navigating the complex path to full SSB.

(4)The Progressive Path: OEMs Driving Semi-Solid Adoption as a Bridge

For many automakers and their battery partners, a phased approach, starting with semi-solid batteries that are closer to existing technology, offers a less disruptive path to market while gaining experience for future all-solid systems.

Sunwoda: Sunwoda follows a clear semi-solid to all-solid progressive roadmap. Their first-generation semi-solid battery, achieving 300 Wh/kg, is targeted for consumer electronics like phones and cameras to boost endurance. A second generation, reaching 400 Wh/kg, is in pilot scale and planned for vehicle validation in 2025, poised to enhance EV performance.

Sunwoda's all-solid ambitions are significant. Their third-generation polymer composite all-solid battery has been lab-verified with an ambitious target of 700 Wh/kg. Product development is aimed for 2025, with mass production planned for 2026, targeting an initial capacity of 1 GWh and a cost below 0.2 CNY/Wh. A first-generation all-solid battery (400 Wh/kg) is already undergoing small-scale trials, also planned for 2026 mass production.

Compared to leaders like CATL, Sunwoda's pace is similar, but their technical route leans more towards polymer composites rather than sulfides, presenting different technical challenges and opportunities. Their patent strategy focuses on polymer composite solid-state electrolytes to address flammability while improving ionic conductivity. Potential patent areas include composite electrolyte formulas (combining polymer with oxide/sulfide), chemical stability improvements (doping, coating), and interface engineering (in-situ film formation, gradient structures to reduce impedance – a key challenge, aiming for >80% capacity retention over 2000 cycles in lab tests). High-energy density cell design patents cover innovations in high-nickel cathodes and silicon-carbon anodes, and structure optimization to reduce inactive material weight. Collaboration with institutions like the Songshan Lake Materials Laboratory provides access to talent and resources, facilitating joint patenting.

Sunwoda's planned all-solid mass production in 2026 aligns closely with the industry's projected 2027 timeline for the "year of industrialization." Semi-solid batteries are likely to debut in consumer electronics, with vehicle-grade all-solid batteries entering market post-2026 after scale validation. This phased commercialization balances technological ambition with market readiness.

Tallan New Energy: Tallan distinguishes itself with a unique anode-free solid-state battery concept at its core, implemented through a phased '4321' strategy. Their semi-solid pioneering phase features an anode-free design where a composite solid-state electrolyte layer replaces the traditional separator and anode material, offering advantages like over 10% raw material cost reduction and dendrite suppression, further enhanced by Internal Short Circuit Prevention Technology (ISFD). This design is compatible with various cathode chemistries (NCM, LFP, etc.).

The all-solid breakthrough phase has already yielded impressive results: a 720 Wh/kg all-solid lithium metal battery lab sample in 2024, setting a new industry record. They plan to introduce an anode-free all-solid battery before 2030, which retains only the cathode, a radical design simplification with potential applications in low-altitude aircraft and consumer electronics due to even higher potential energy density.

Tallan's patent strategy focuses on four core areas. Electrolyte material/structure patents cover their oxide-polymer hybrid electrolyte addressing interface resistance and mass production challenges. Battery structure innovation patents protect their anode-free design and its contribution to higher energy density and mass production timelines. Manufacturing process patents include a fixture patent optimizing welding/cutting (reducing yield loss from failures) and electrode composite technology combined with interface softening, simplifying production. A fast-charge strategy patent uses an electrochemical-thermal model to optimize charging rates, mitigating dendrite risk during fast charging. Their patents also cover stability solutions for extreme conditions via thermal management.

Their '4321' roadmap includes semi-solid prototype validation and small-scale mass production (dates not specified beyond "202x"), followed by vehicle installation in collaboration with Changan Automobile ("202y"). By 2030, they aim for commercialization of the all-solid, anode-free battery for low-altitude and consumer electronics markets. Tallan's unique technological bet on anode-free design, combined with a structured phased approach and strong IP, positions them as an innovative player.

Changan Automobile: Changan follows a liquid-to-semi-to-all-solid progressive R&D path, prioritizing breakthroughs in electrolyte materials, energy density, and fast charging. They plan to begin gradual semi-solid battery mass production this year (2024), targeting 350-500 Wh/kg. Semi-solid widespread adoption is expected by 2030. For the higher-performance all-solid batteries, Changan aims for mass production acceleration by 2027, targeting 400 Wh/kg initially.

Changan is heavily investing in R&D, with an Advanced Battery Research Institute, a team of 1200, and a 10 billion CNY investment. Collaborative efforts are key; their joint venture with Deepal and CATL (Era Changan) has developed an 87Ah standard cell supporting 4C fast charging (20% to 80% in 10 minutes), boosting their fast-charging capabilities.

Changan's patent strategy spans electrolyte innovation, structure optimization, and manufacturing process improvements, combining self-development with collaborative efforts. In electrolytes, they are exploring both sulfide (with Huawei, leveraging N-doped sulfide for improved interface stability, anti-dendrite growth, and anti-shuttle effects, potentially leading to joint patents) and polymer systems (their organic electrolyte patent using sulfonyl and epoxy bonds achieves high conductivity (10−3 S/cm) and compatibility with high-voltage cathodes like LiMnNiO4, supporting semi-solid transitions).

Structure optimization includes the anode-free design developed with Tallan. For all-solid interface resistance, they are exploring lithium metal anode prelithiation (in-situ Li nucleation to improve contact and reduce expansion), validated in prototype cells. On the process front, a dry electrode patent with modified binders enhances electrode stability and fits high-voltage systems. Their "reduced material manufacturing" concept (patents cover reducing liquid electrolyte to <10% in semi-solid and electrolyte-free packaging in all-solid) targets 10-15% raw material cost reduction. Changan's innovative CCTV (Cell-to-Vehicle/Chassis) integration patent places cells directly into the chassis, boosting pack efficiency (>86%) and enabling 7C ultra-fast charging (400 km in 7 minutes), a key enabler for semi-solid commercialization. Under their 'Golden Bell Battery' safety brand, an AI remote diagnostic system patent monitors parameters for early thermal runaway warnings, applied to their 2025 all-solid prototype.

Commercialization plans include debuting semi-solid functional prototypes and gradually implementing them in Deepal and Avatr sub-brands. All-solid mass production will be accelerated. By 2030, Changan targets widespread SSB adoption, supporting their goal of 1.05 million NEV sales annually with 50-80 GWh battery capacity. Changan's approach balances ambition and pragmatism, using semi-solid for near-term market entry and targeting all-solid/lithium-sulfur for long-term leadership, focusing patents on electrolyte and integration tech, though a broader core patent coverage might be needed for global competition.

SAIC Group: SAIC Group, leveraging its collaboration with QingTao Energy (SAIC QingTao), follows a three-stage progressive pathway to reduce liquid content. Stage one (2024) successfully introduced 10% liquid semi-solid batteries, exemplified by the IM L6's 'Lightyear Solid-State Battery,' exceeding 300 Wh/kg and enabling over 1000 km range. Stage two (around H1 2025) will see the release of 5% liquid solid-state batteries for IM and other pure electric/PHEV models. Stage three targets all-solid mass production with ambitious goals: 500 Wh/kg, 75Ah capacity, and a 40% cost reduction relative to traditional batteries.

SAIC's patent strategy, closely linked to QingTao's (as detailed in the QingTao section), covers material systems, manufacturing process optimization, and battery structure design. This three-step strategy combined with extensive patenting across the material, process, equipment, and system aspects builds a full-chain technical reserve. While their 2026 mass production target appears feasible, success hinges on overcoming challenges in sulfide electrolyte mass production processes and interface engineering. If they maintain momentum, SAIC QingTao could achieve first-tier mass production vehicle installation globally by 2027, potentially reshaping the NEV industry competitive landscape.

Patent Powerhouse: Mapping China's SSB IP Landscape

The sheer volume and strategic focus of patenting activities across Chinese manufacturers underscore the intensity of their R&D effort and their intent to build formidable technical moats. Companies are not just developing technology; they are meticulously securing their intellectual property across the entire value chain.

The scale is striking, with entities like Chery accumulating over 5,000 SSB-related patent applications by early 2025. Ganfeng Lithium holds over 280, and WeLion over 590. This reflects a widespread commitment to IP protection.

Patent efforts generally cluster around four critical areas, mirroring the fundamental challenges of SSB:

Electrolyte Materials & Synthesis: This is the bedrock. Patents cover novel compositions (e.g., sulfide/halide composites for stability/low temp, oxide/polymer hybrids for conductivity/processability), synthesis methods (optimizing particle morphology, controlling impurities), and material modification techniques (like doping in sulfides or incorporating biodegradable elements in oxides as seen with Gotion) to boost ionic conductivity, chemical stability, and mechanical properties.

Interface Engineering: The Achilles' heel of SSBs – the poor contact and high resistance at the solid-solid interface between electrode and electrolyte. Patents in this area focus on creating stable, low-resistance interfaces through methods like in-situ film formation (Sunwoda, Changan), applying specialized coatings (SVOLT's electrolyte coating), designing interlayers (CATL's sandwich structure), or optimizing electrode structures (Geely's variable thickness electrodes, QingTao's Li enrichment film) to facilitate seamless ion transfer. These efforts are crucial for battery performance, cycle life, and charging speed.

Battery Structure & Design: Beyond materials and interfaces, patents optimize the physical structure of the cell and module. This includes innovative cell designs (Tallan's anode-free concept, Changan's CCTV integration), internal cell structure optimizations (QingTao's "Roll Heart" winding), and module-level solutions (SVOLT's elastic connectors for expansion, Geely's battery swap station design). These patents address mechanical integrity, energy density per volume, manufacturability, and system-level integration.

Manufacturing Processes & Equipment: Translating lab success to mass production requires scalable, cost-effective processes. Patents cover key manufacturing steps like dry electrode technology (CATL, QingTao, Changan, improving efficiency and compatibility), slurry preparation (BYD ensuring uniformity), sintering methods for oxide/sulfide electrolytes (Geely), and specific assembly techniques (Tallan's welding/cutting optimization, Farasis's SP technology). IP in this domain is critical for lowering production costs and improving yield.

Safety & Thermal Management: Despite inherent safety advantages, ensuring robust performance under abuse or extreme conditions is vital. Patents include self-shutdown features (Farasis), thermal runaway early warning systems using AI (Changan), and thermal management designs (WeLion, Tallan) to maintain optimal operating temperatures and prevent localized overheating.

The sheer breadth and depth of these patent filings across multiple companies signal a mature R&D ecosystem actively tackling the core challenges of SSB technology. While the volume is impressive, the true measure lies in the quality and enforceability of core patents, particularly in cutting-edge areas like high-conductivity electrolyte formulas and stable interface technologies, where global competition is fierce. China's domestic strength provides a strong foundation, but securing globally relevant IP will be key for international market penetration.

The Accelerated Road to Market: China's Commercialization Timetable

Based on the aggregated plans and achievements of these key players, a clear, phased commercialization roadmap for solid-state batteries in China emerges:

2024-2025: The Semi-Solid Pre-Scale-Up Era

This period marks the culmination of significant R&D into semi-solid batteries.

Technology: Liquid electrolyte content typically ranges from 5% to 15%. Energy density falls between 300 and 360 Wh/kg. Cycle life reaches 1000 to 2000 cycles.

Commercialization: Leading companies like CATL, WeLion, and QingTao are achieving mass production and vehicle installations (e.g., IM L6 with QingTao's battery).

Market Penetration: By 2025, semi-solid batteries are projected to achieve a penetration rate of 5% to 8%, primarily targeting high-end vehicle segments priced above 300,000 CNY.

Other Applications: Adoption in energy storage is accelerating, with projects like the Zhejiang Longquan semi-solid storage station coming online.

Cost: Semi-solid batteries currently command a premium, costing 20% to 30% more than comparable liquid batteries, with prices around 1.2 to 1.5 CNY per Wh.

2026-2027: The All-Solid Pilot Validation Chapter

This phase witnesses the initial emergence and testing of true all-solid batteries.

Technology: Characterized by entirely solid electrolytes. Energy density climbs to 400 to 500 Wh/kg. Cycle life surpasses 2000 cycles.

Commercialization: Companies like CATL, BYD, and Gotion High-Tech plan to unveil all-solid battery samples and commence installation testing in high-end vehicles (e.g., BYD's luxury million-CNY class cars, Hongqi's L-series).

Early Adopters: The low-altitude economy sector (e.g., EHang intelligent flight vehicles) is anticipated to be among the first large-scale application scenarios for all-solid batteries due to their critical need for high energy density and safety.

Cost: Initial all-solid batteries will be significantly more expensive, estimated at 2 to 3 CNY per Wh, two to three times the cost of liquid batteries.

2028-2030: The All-Solid Mass Adoption Horizon

This period is projected as the turning point for widespread all-solid battery deployment.

Technology: Sulfide/halide composite electrolytes are expected to become prevalent, enhancing performance. Energy density will consistently exceed 500 Wh/kg. Low-temperature performance will see significant improvements, with capacity retention above 90% even at -30°C.

Market Penetration: By 2030, all-solid batteries are forecast to reach a 15% to 20% penetration rate, expanding into mainstream vehicle segments priced above 200,000 CNY.

Storage Impact: In the energy storage sector, costs are projected to drop below 0.8 CNY per Wh, making SSBs competitive with and potentially displacing some LFP applications.

Cost Parity: Crucially, all-solid battery costs are targeted to achieve parity with liquid batteries, falling to the 0.6 to 0.8 CNY per Wh range.

This timeline, while ambitious, demonstrates a clear strategic intent across the Chinese battery industry to move rapidly from transitional technologies to full solid-state solutions.

Navigating the Future: Challenges and Opportunities

China's progress in solid-state batteries is undeniable, marked by diverse technical exploration, aggressive R&D, extensive patenting, and clear commercialization roadmaps. However, the path is not without significant hurdles, which are openly acknowledged within the industry.

Technical Pain Points:

Sulfide Stability and Processing: While promising high energy density, the inherent chemical instability of sulfide electrolytes and the complexity/cost of manufacturing them in inert environments remain major technical bottlenecks for widespread adoption.

Solid-Solid Interface: Achieving stable, low-resistance contact across the solid interfaces between electrodes and electrolyte is a fundamental challenge affecting performance, cycle life, and charging speed. Despite innovative approaches like interface coatings and structural designs, optimizing this remains a key R&D focus.

Oxide Conductivity: For oxide electrolytes, improving ionic conductivity, especially at lower temperatures, is essential to unlock their full potential for faster charging and better performance in diverse climates. Composite approaches with halides are one strategy to address this.

Scaling High Energy Density: While high energy densities are demonstrated in lab samples, consistently achieving and maintaining these levels in larger format cells suitable for EVs, while ensuring safety and cycle life, is a complex engineering challenge.

Manufacturing Hurdles:

Scalability: Transitioning from pilot lines to gigawatt-hour scale production for complex SSB manufacturing processes, particularly for sulfide, requires massive investment in new equipment and refining production techniques.

Cost Reduction: Bringing down the cost of SSB materials, especially electrolytes and advanced electrode materials compatible with solid electrolytes, is critical to reach price parity with liquid batteries and enable mass adoption.

Standardization: Developing and standardizing manufacturing processes (like dry electrode or stacking) across the industry is necessary to accelerate adoption and build a robust supply chain.

Market Dynamics:

Initial High Cost: The high initial cost limits early SSB adoption to premium or specialized markets, requiring patient investment and gradual cost reduction strategies.

Supply Chain Maturity: A dedicated supply chain for SSB-specific materials and components is still maturing, requiring close collaboration between battery manufacturers, material suppliers, and equipment providers.

Despite these challenges, China's advantages are clear: a massive domestic market, a robust existing battery manufacturing ecosystem and supply chain (leveraged from liquid batteries), strong government support, and a highly competitive and rapidly innovating pool of companies. The aggressive timelines, coupled with diverse technical bets and extensive patenting, indicate China's firm intent to lead this next battery revolution. While global players like Toyota and Samsung SDI also target around 2027 for sulfide SSB mass production (as mentioned in the transcript analysis of international context), China's scale, integrated ecosystem, and speed of execution position its manufacturers strongly in this global race. The objective reality is a landscape of ambitious targets, significant technical progress, ongoing challenges, and a clear trajectory towards a solid-state future.

Strategic Considerations for Global Procurement Professionals

For those involved in sourcing battery technology for automotive, energy storage, or other demanding applications, China's solid-state battery landscape presents both complexity and compelling opportunities.

Understand the Technical Diversity: There isn't one "Chinese SSB." Recognize the fundamental differences between sulfide, oxide, composite, and progressive routes. Each offers different trade-offs in performance, cost, and maturity. Align your technical requirements (energy density goals, safety standards, charging speeds, operating temperature ranges) with the strengths and weaknesses of each route and the companies pursuing them.

Assess Supplier Strategy: Evaluate potential partners based on their stated technical roadmap, their R&D investment, the depth and focus of their patent portfolio (especially in core areas like electrolytes and interfaces), their industrialization experience (even from liquid batteries), and their supply chain relationships.

Factor in the Timelines: The projected timeline provides a framework for strategic planning. Semi-solid batteries are a near-term reality, offering performance boosts now with potentially higher costs. All-solid batteries are a mid-term prospect with higher performance potential but also higher initial risk and cost. Plan your technology adoption based on these phased advancements.

Total Cost of Ownership: Beyond initial purchase price, consider the total cost of ownership, including potential maintenance (initial SSB replacement costs could be high) and the long-term benefits of improved cycle life and safety. For EVs, also consider the impact on vehicle range and charging infrastructure utilization.

Collaboration is Key: The complexity of SSB development necessitates close collaboration throughout the value chain. Suppliers are actively seeking partnerships (material providers, equipment manufacturers, and OEMs). Engaging early can provide valuable insights and potential for tailored solutions.

China's commitment to mastering solid-state battery technology is set to reshape the global energy storage landscape. The diverse technical pathways, the aggressive R&D push, the extensive patenting, and the clear commercialization timelines paint a picture of a rapidly evolving field. While challenges remain in scaling production, reducing costs, and perfecting performance across all conditions, the momentum is undeniable. Staying informed and engaging directly with key players in this dynamic environment is essential for navigating the future of battery technology.

For those requiring granular detail on specific technical pathways, in-depth analysis of manufacturer capabilities, or looking to explore potential collaborations within China's solid-state battery ecosystem, further detailed discussion is invaluable. To connect with experts and delve deeper into these critical advancements shaping the future of energy storage and electric mobility, you are welcome to reach out.

Contact: William +86 186 6977 8647